Rumored Buzz on The Wallace Insurance Agency

Wiki Article

Excitement About The Wallace Insurance Agency

Table of ContentsExamine This Report on The Wallace Insurance AgencyUnknown Facts About The Wallace Insurance AgencyThe Single Strategy To Use For The Wallace Insurance AgencyTop Guidelines Of The Wallace Insurance AgencySome Of The Wallace Insurance AgencyThe Wallace Insurance Agency for BeginnersThe 10-Minute Rule for The Wallace Insurance AgencyAn Unbiased View of The Wallace Insurance Agency

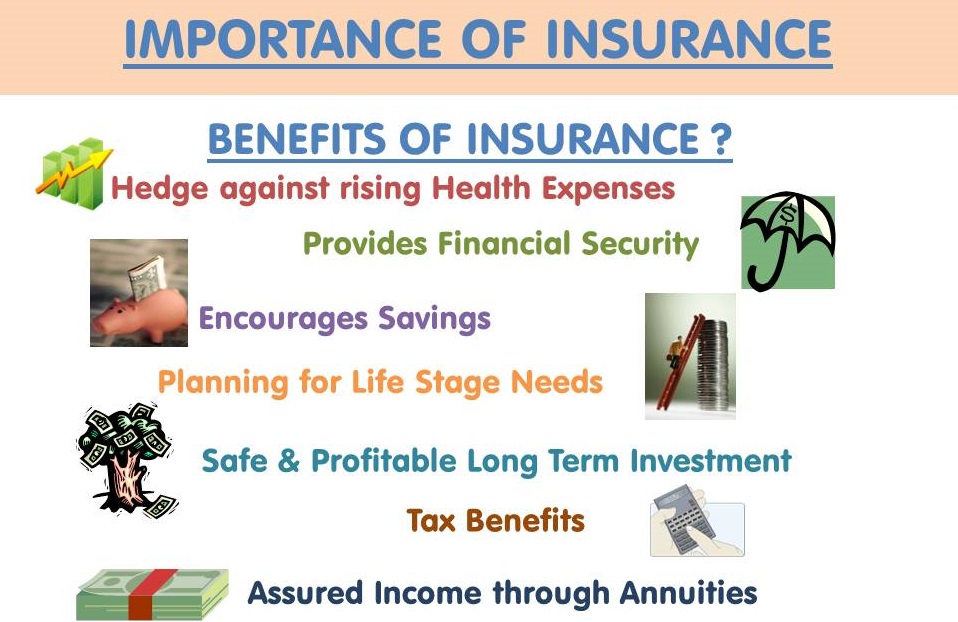

These strategies likewise use some security component, to help make certain that your recipient gets economic settlement should the unfortunate happen throughout the tenure of the plan. Where should you start? The simplest means is to start considering your concerns and demands in life. Right here are some inquiries to get you began: Are you seeking higher hospitalisation coverage? Are you focused on your family members's well-being? Are you trying to conserve a great sum for your kid's education demands? The majority of people start with among these:: Versus a background of climbing medical and hospitalisation expenses, you may want bigger, and greater protection for medical expenses.Ankle sprains, back strains, or if you're knocked down by a rogue e-scooter biker., or typically up to age 99.

Facts About The Wallace Insurance Agency Uncovered

Depending upon your insurance coverage plan, you obtain a round figure pay-out if you are completely impaired or critically ill, or your enjoyed ones obtain it if you pass away.: Term insurance supplies insurance coverage for a pre-set time period, e - Insurance quotes. g. 10, 15, two decades. Due to the shorter coverage period and the lack of cash worth, costs are generally lower than life strategies, and gives annual money advantages on top of a lump-sum amount when it matures. It commonly includes insurance policy protection versus Complete and Irreversible Handicap, and death.

The 25-Second Trick For The Wallace Insurance Agency

You can select to time the payment at the age when your child mosts likely to university.: This gives you with a monthly revenue when you retire, normally on top of insurance coverage coverage.: This is a way of saving for short-term goals or to make your cash work harder against the pressures of rising cost of living.

The Wallace Insurance Agency Can Be Fun For Everyone

While getting various plans will certainly provide you much more comprehensive coverage, being extremely safeguarded isn't an advantage either. To stay clear of unwanted economic tension, compare the plans that you have versus this checklist (Life insurance). And if you're still unsure regarding what you'll require, exactly how a lot, or the type of insurance policy to obtain, get in touch with a financial consultantInsurance coverage is a long-term commitment. Always be prudent when making a decision on a strategy, as changing or terminating a plan prematurely normally does not yield monetary advantages.

All About The Wallace Insurance Agency

The very best component is, it's fuss-free we immediately exercise your money streams and offer cash tips. This article is implied for information just and needs to not be trusted as financial guidance. Before making any decision to acquire, offer or hold any type of financial investment or insurance coverage product, you should look for suggestions from an economic advisor regarding its suitability.Spend only if you understand and can monitor your financial investment. Diversify your financial investments and stay clear of investing a large section of your cash in a single item company.

The 8-Minute Rule for The Wallace Insurance Agency

Just like home and auto insurance policy, life insurance coverage is important to you and your family's financial protection. To aid, let's explore life insurance in more detail, exactly how it works, what value it might offer to you, and exactly how Bank Midwest can help you find the best policy.

It will help your family pay off debt, get income, and reach significant economic goals (like college tuition) in the occasion you're not right here. A life insurance policy policy is essential to planning these monetary considerations. For paying a monthly costs, you can get a collection amount of insurance protection.

The Facts About The Wallace Insurance Agency Uncovered

Life insurance coverage is ideal for virtually every person, even if you're young. People in their 20s, 30s and even 40s usually see it here overlook life insurance.The more time it takes to open up a plan, the even more threat you encounter that an unforeseen event might leave your household without insurance coverage or economic aid. Relying on where you go to in your life, it is essential to know exactly which kind of life insurance policy is ideal for you or if you require any kind of in any way.

The Wallace Insurance Agency Things To Know Before You Get This

A property owner with 25 years remaining on their home loan could take out a plan of the exact same size. Or let's claim you're 30 and plan to have children soon. Because instance, enrolling in a 30-year plan would certainly secure in your premiums for the following three decades.

Report this wiki page